What is payment tax. How do I create, edit and delete this tax?

562 views

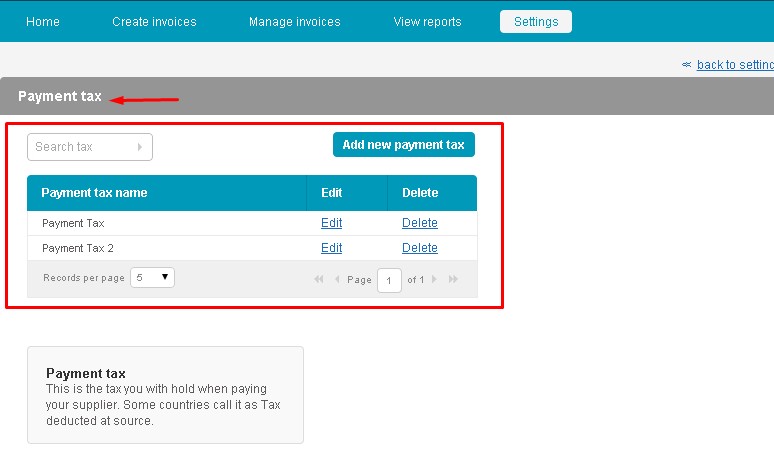

Payment Tax

‘Tax you with hold when paying your supplier are known as payment tax.

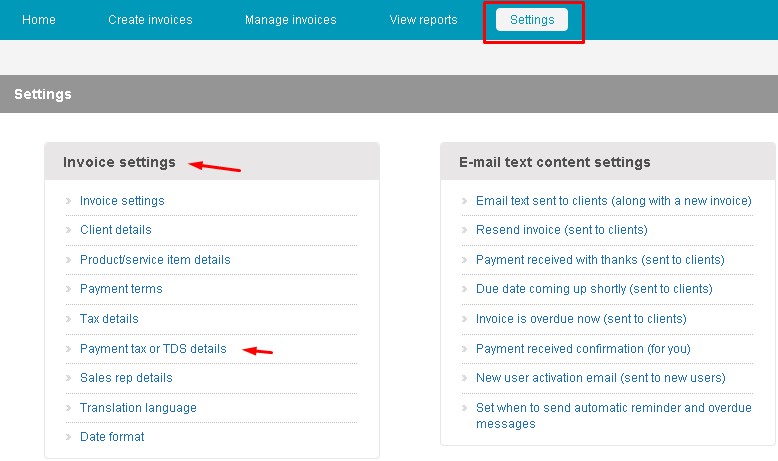

How can I create payment tax?

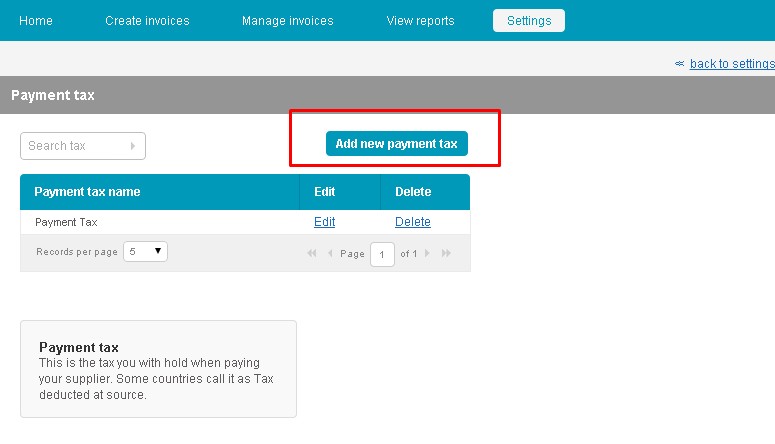

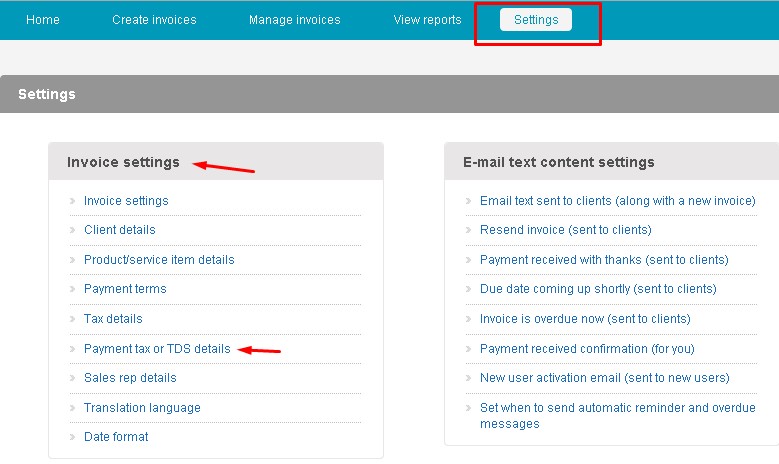

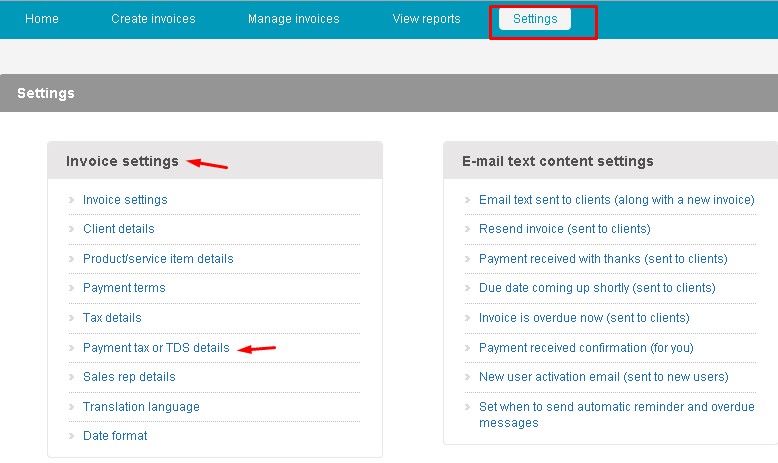

• Go to Settings, under Invoice Settings select Payment Tax or TDS details option.

• Click on Add new Payment Tax button

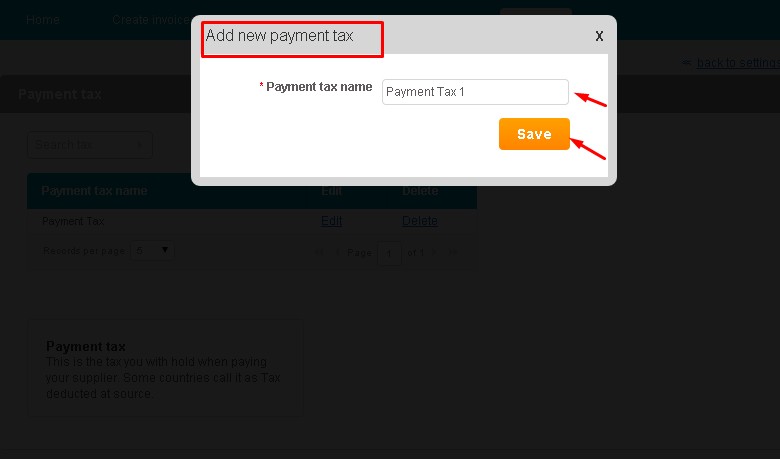

• The ‘Add Enter Payment tax name and click on Save button.

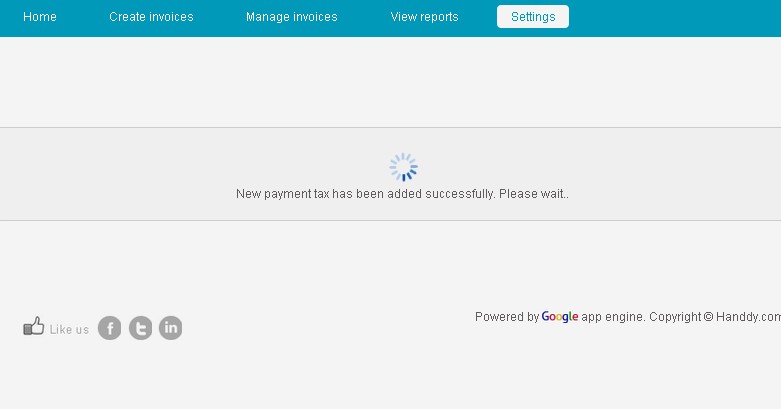

• You will get a message stating “Payment tax has been added successfully.”

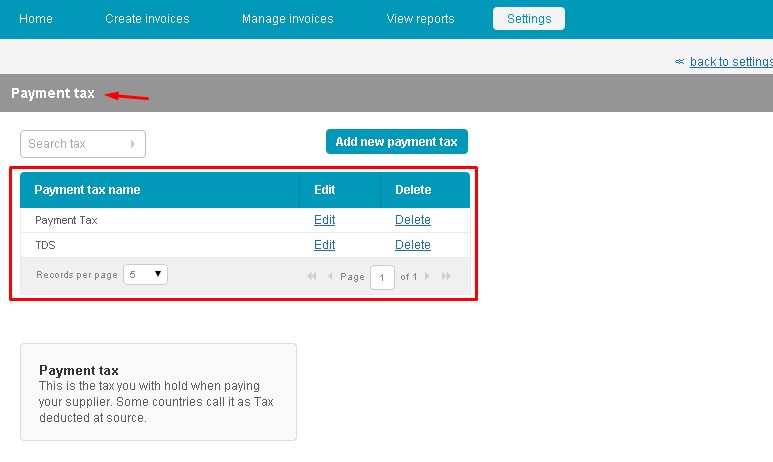

• Tax will be successfully added to the list.

How do I edit payment tax ?

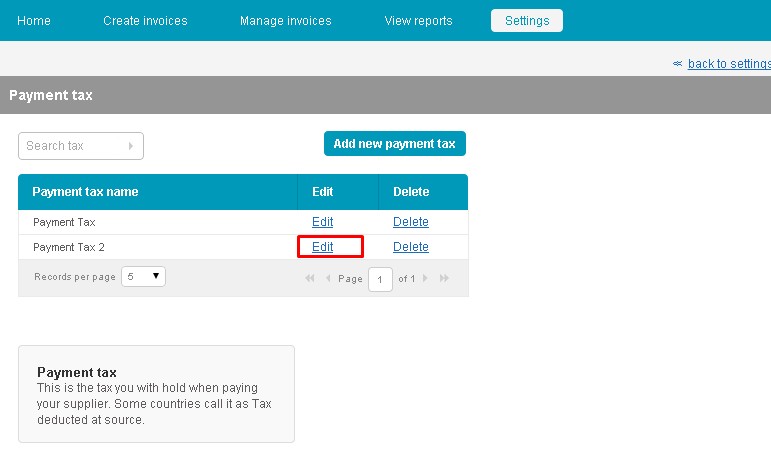

- Go to Settings, under Invoice Settings select Payment Tax or TDS details option.

- List of Payment Tax details that you have saved will appear as follows.

- From list, click on Edit link for the Payment Tax you wish to edit

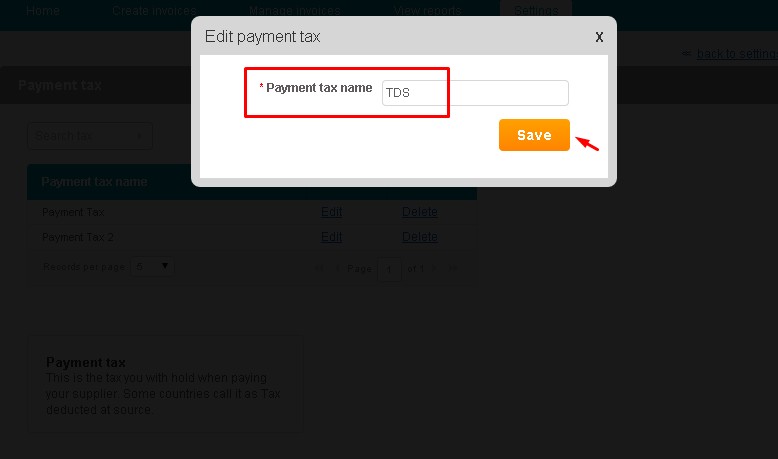

- In the Edit Payment Tax dialogue box that opens up, make the necessary edits and click on Save option.

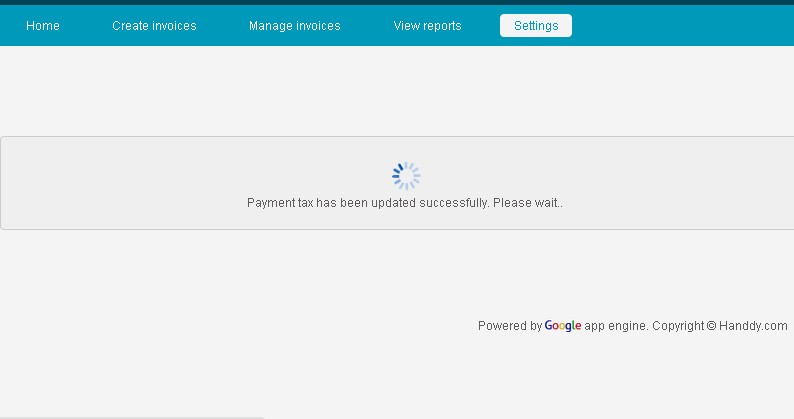

- You will get a message stating your Tax has been updated successfully.

- The edited Payment Tax will appear in the payment tax list as follows

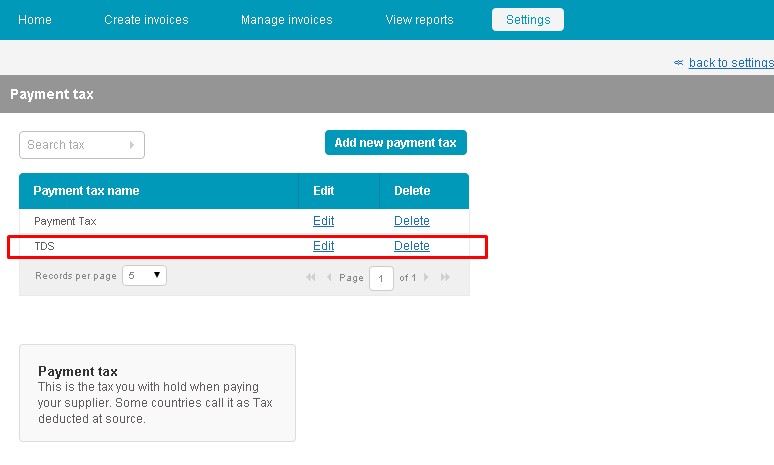

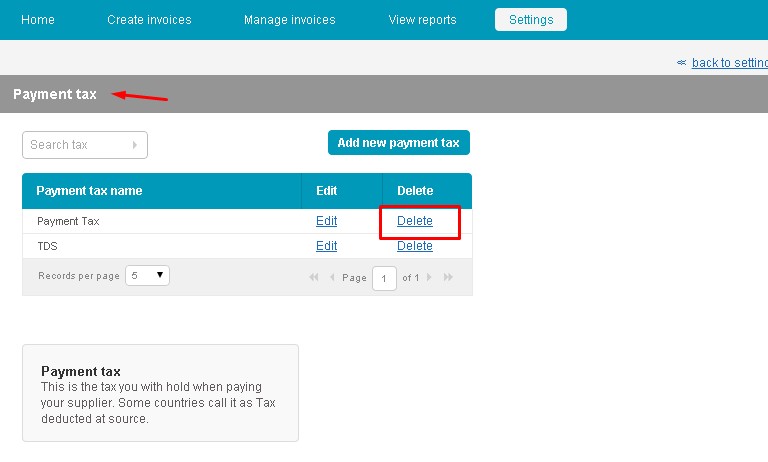

How do I delete payment tax?

- Go to Settings, under Invoice Settings select Payment Tax or TDS details option.

- The list of payment taxes you saved will appear

- From list click on Delete link that appears next to the payment tax that you wish to delete.

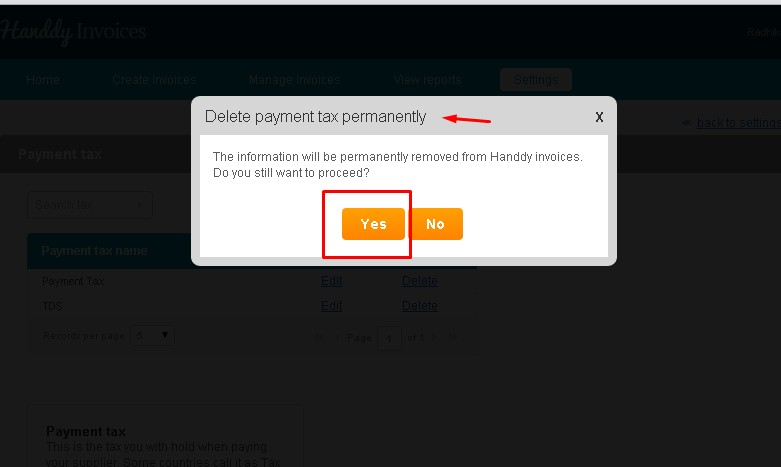

- In the Delete payment tax permanently dialogue box select ‘Yes’ option.

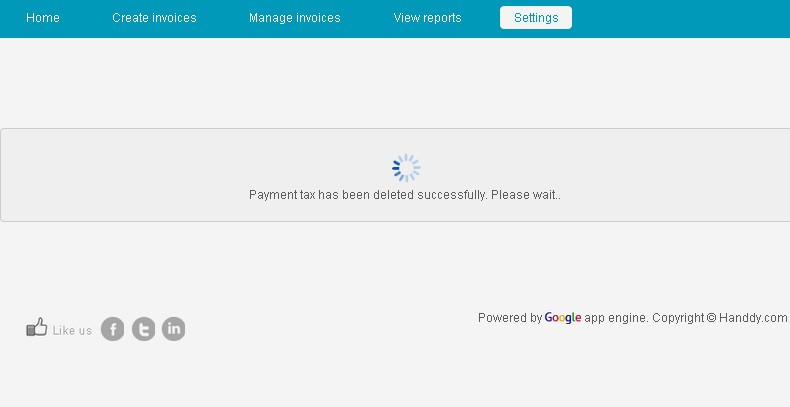

- You will get a message stating your Tax has been deleted successfully

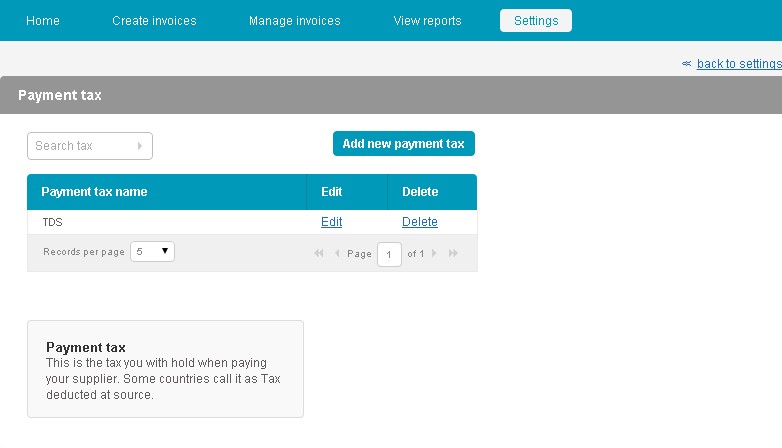

- The erased tax no longer appears in the payment tax list

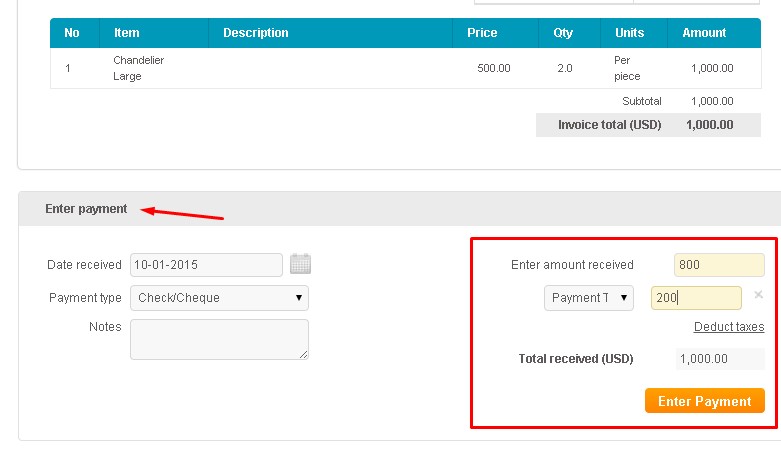

How do I enter the payment tax when paying my supplier?

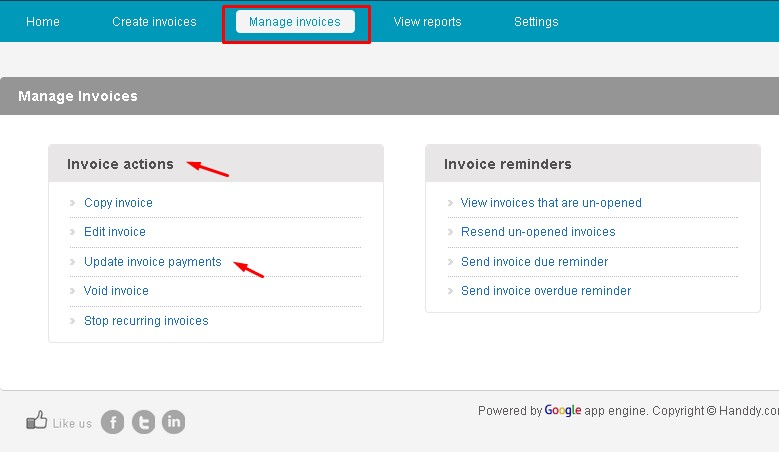

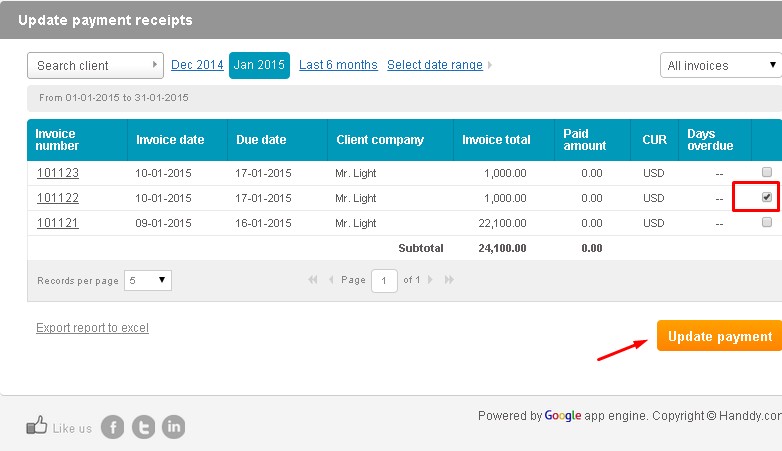

- In Manage invoices under Invoice Actions, select update invoice payments option.

- For the invoice you wish to update payment for, click on invoice number link

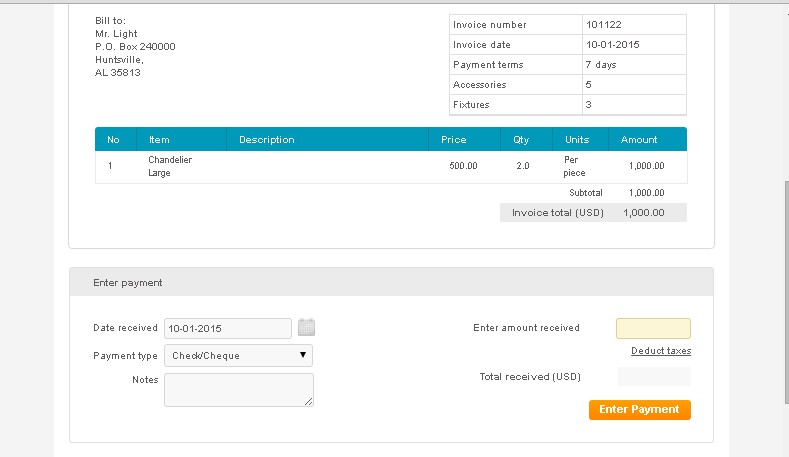

- The respective invoice opens up as follows

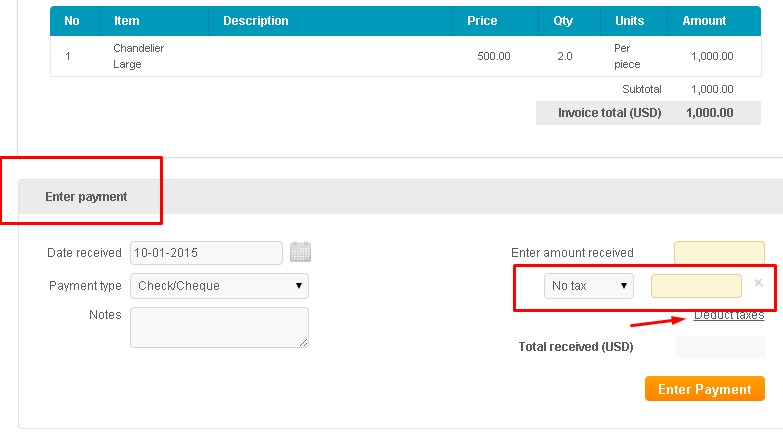

- in Enter payment section, select Deduct tax tab and the Tax and percentage tab opens up.

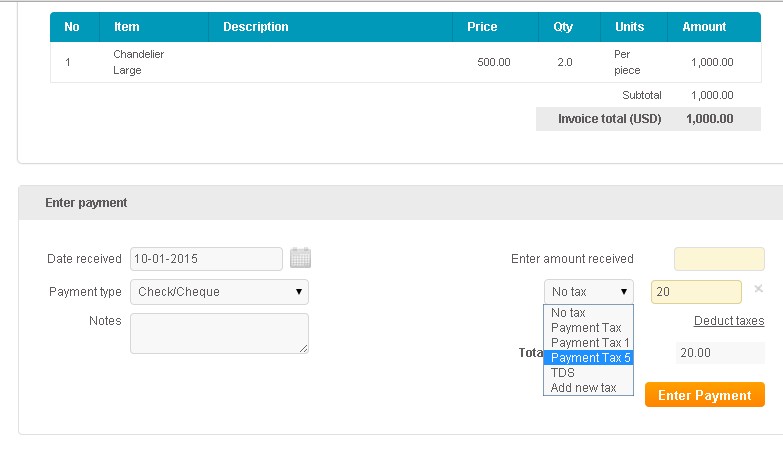

- In the Tax and percentage tab Add taxes link select the tax you wish to add and enter % amount.

- This is how payment tax will be reflected in the invoice while charging your supplier.

* * * * * * * * * * * *