What is Tax over tax and when to use them?

263 views

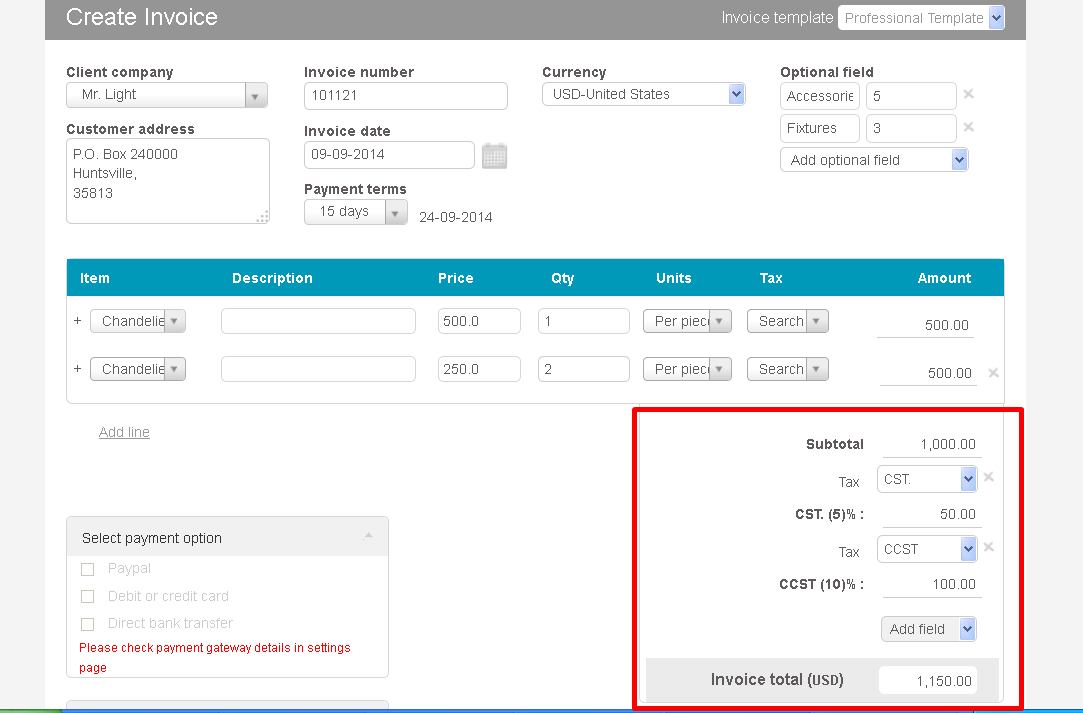

- This tax is added when you need to add a tax for a tax below the subtotal.

Ex: You have a tax (CST 5%) and you have to add another tax for only this tax amount (CESS 10%)

This is how you would enter it in the invoice

Subtotal XXX

CST (5%) XX

CESS (10%) X This CESS tax of 10% is added only to the CST tax of 5% and not to the subtotal

Invoice total XXXX

How to set this up in Handdy invoices

Step 1) Create a standard tax CST (5%)

Step 2) Create a Tax over tax CESS (10%)

Step 3) Under the Subtotal . Select standard tax first (CST) and after that select the Tax over tax (CESS)